The Spanish economy is one of the strongest in Europe, with tourism, real estate and construction all contributing to this growth. However, while the country's economic prosperity has primarily benefited the urban areas of Spain, it's also causing a shift in how people invest their money.

In this article, we will explore why it may be time for investors to look beyond Madrid and Barcelona and consider other overlooked places in Spain for real estate investment opportunities.

Cash flow is king.

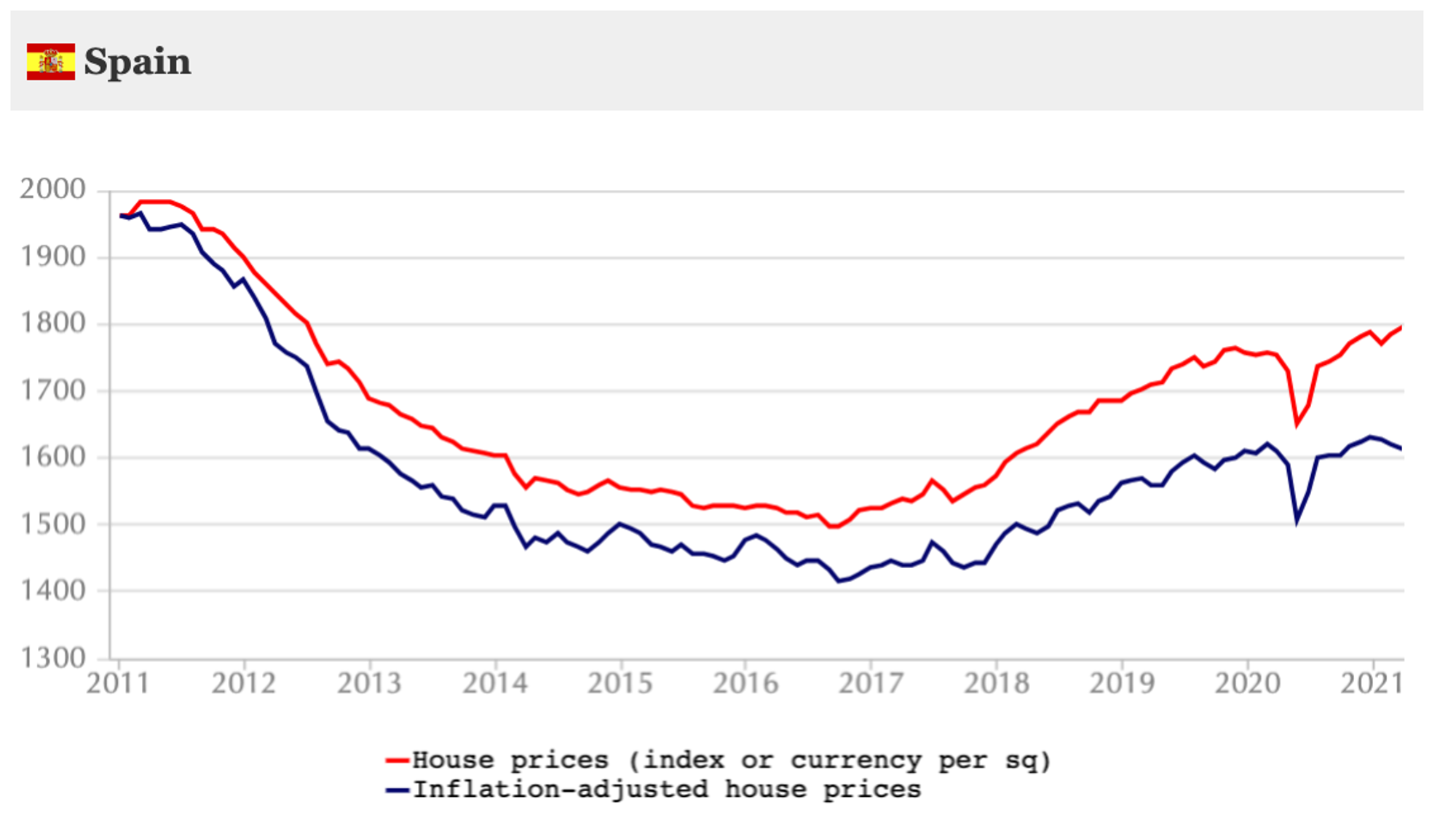

With the memory of the 2008 crash still fresh, many investors are hesitant to rely on capital growth in the Spanish market. Many properties lost over 50% of their value following the crash. Many owners ended up overleveraged, and many lost their homes. After almost 15 years, we are starting to see prices stabilise and in certain regions begin to climb.

Despite this excellent sign, we mainly focus on yields at Asai and consider our investments permanent.

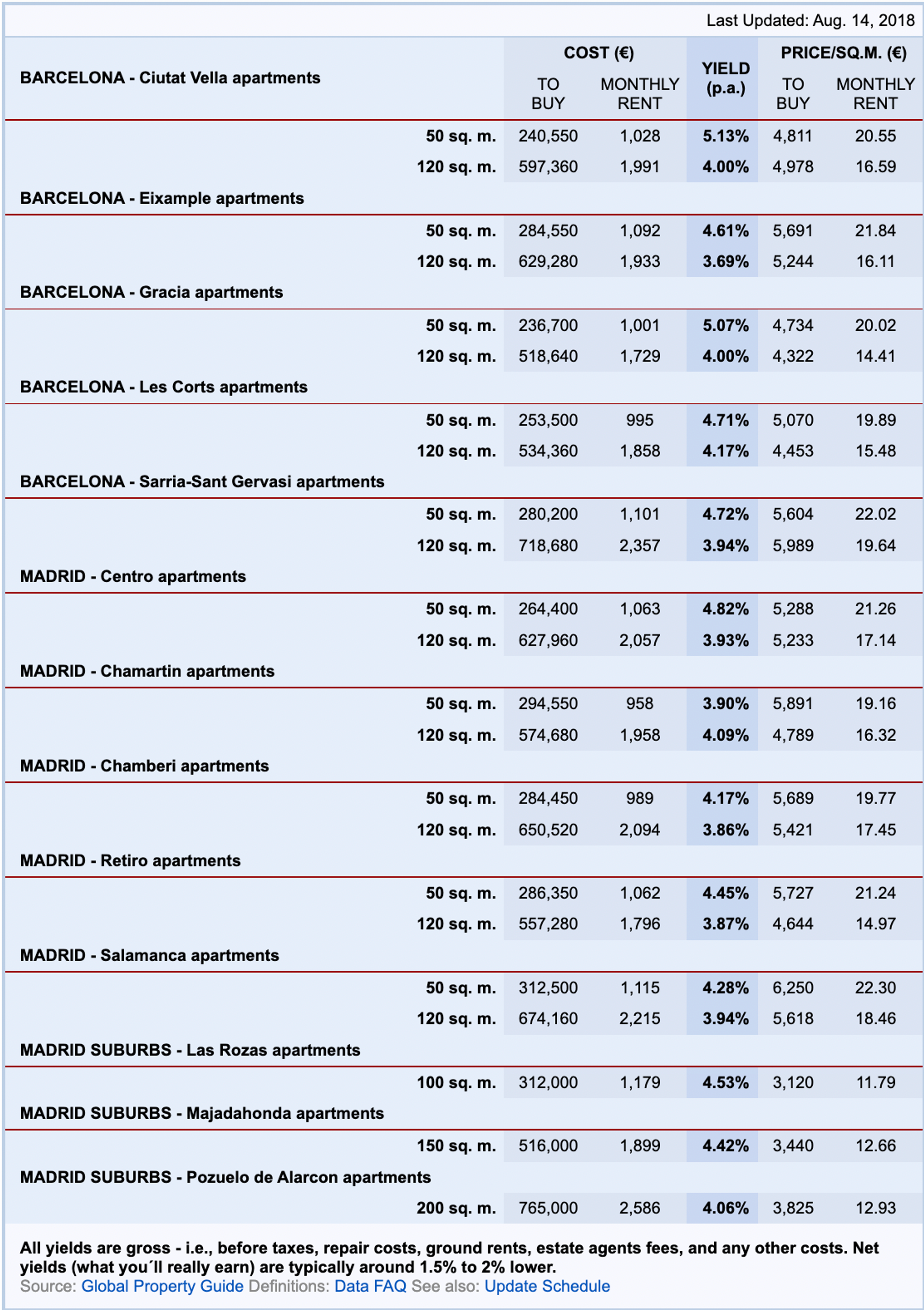

In Spain, the most commonly used measure of yield is calculated by dividing the rental income by the value of the property (yield = rent/price). This measure is sometimes referred to as Gross Yield. To put this into context: a yield of 5% per year means that you will make €5k a year from your €100k investment.

Many investors assume Madrid and Spain, or the ever-sunny south of Spain, have the highest yields in Spain. Indeed, most real estate deals in the country are for these regions.

However, data suggests otherwise. According to GPG, Madrid offers one of the poorest yields in Europe. Even the golden city of Barcelona is not much better than Madrid.

So, where should we look beyond the hype?

- Location: The location of any property and its audience are significant factors in determining its profitability. Consider the location of historic town centres, uncommon tourist hotspots, close-by educational institutions or industry. Each will bring a particular profile of the eventual customer to your door.

- Property type: Different types of properties have different levels of risk associated with them as well as different levels of return potential. For example, a townhouse may have higher rental yields than other properties but requires more than one tenant and additional maintenance beyond your standard home. A detached villa can provide greater privacy and security for your tenants. However, its yield would not justify the investment.

- Condition: How much work needs to be done before renting out? Will it require extensive renovations or just some minor fixes here and there? The standard advice is to find properties with less headache. However, contrary to this line of thought, we believe that properties that need extra attention and care initially offer the best investment deals.

Let's consider the former mining region southwest of Bilbao, known as Bizkaia (or Biscay).

The region is in the southwest of the province of Bizkaia, just inland from Bilbao. It has historically been a mining, fishing and industrial area. Still, it is now known as an area of outstanding natural beauty with a mild climate and plenty to do outdoors. Despite many challenges, the region has maintained its unique and ancient culture, language, artform and myths, which is a testament to the local's strength of spirit and depth of connections.

The industry has pivoted to clean tech, precision manufacturing and finance. Bizkaia's capital, Bilbao, is now a role model for any city looking to revitalise and regenerate, leveraging culture and art.

Dotted around this old industrial region are quiet towns and villages that property developers and investors have largely ignored for decades. This is primarily due to historical and political prejudice.

We consider investing in this region because it has a thriving local economy despite its lack of external investment or outside attention. Unlike the south of Spain, nature has been protected and given priority. And the towns have maintained their historical charm.

In addition, this area of Spain is not facing a de-population problem, and we suspect that we would observe more migration to this region.

If you can see potential where others see only problems, you may find yourself with a profitable investment opportunity.

The average prices in the Basque Country are generally higher than in many other regions in Spain. But the rents are relatively healthy thanks to its growing economy and population. As such, we can find winning yields that are hard to come by in other regions.

We believe the upcoming infrastructure projects (including the new Guggenheim museum), focus on green tech, and continuous migration will offer strong inflation protection with significant downside protection.

Conclusion

Like any other market, higher returns tend to come from areas that are less developed or overlooked by investors. Not getting too carried away with the hype surrounding popular investment locations such as Madrid or Barcelona is imperative. If you look outside of these places and consider what makes a good ROI (return on investment), it's possible to find gems in regional real estate that provide a much better risk-adjusted return for investors.